Why is it reasonable to have amex platinum cards

Platinum Card® from America Express and Business Platinum Cardin® from America Express has developed as their cards if you are interested in luxury programs. With the most full rewards and the same benefits, it makes sense to ask what is best for you. Or, if you already have one of the cards, you may wonder if you should also be good for the other.

It can actually work in your desire to make both cards your cards in your bag – even if the $ 695 year charges on each platinum (see the Amex Platinum funds).

Each card has benefits of helping others and travelers will not have a problem for year’s time, which makes them a large combination when it comes to finding more on your journey.

Here’s why you can want both in your bag.

The fair value of the assignment offer

Both both cards come with the best offer. Currently, new Platinum Card Platinum cards can earn 150,000 bonuses after using $ 20,000 in the first three months of the card.

With the Amex Platinum, new cards can earn 80,000 bonuses after spending $ 8,000 in the first six months of the Cardmatch Tool – dependent on any time and not everyone will be referred to the same offer.

If you apply for both cards and find complete bonuses acceptable, you will receive at least 230,000 membership points based on TPG’s March 2025, costing $ 4.600 more than three years of annual coins.

Related: Does the Amex Business Platinum cost an annual fee?

Card cards

Both cards have a number of credit cards to find the number each year. Registration is required for the acquisition of the selected benefits; Conditions apply.

Daily newspaper

Update your Inbox and TPG Daily Newsletter

Join more than 700,000 students on matters, deeper guidelines and specialized deals from TPG experts

Usually, one of the easiest ways to profit platinum cards are this statement for the flight payment statement that will receive each year of the calendar.

Each card has a 200-day Statement for 200 days for the year for each date of the calendar year (required registration). While not as generous as $ 300 to travel in accordance of the year you will receive a Chase Sapper Reserve® (What can be used in any moving purchase), debt with the Amex Platinum cards are very useful.

Over airplanes, platinum card is loaded with an annual offer. Cardmembers enjoy the following (other benefits requires registration):

When it comes to annual statements of the year, the Business Platinum is not rejecting, or. It provides for $ 400 in a statement of each calendar announcement at the Hilboot Credits statement (up to $ 90 Calonents (up to $ 120 in the Calendar Calendar year by buying us the wireless users. (up to $ 10 per month). Dell and Adobe Credits will end in June. 30.

Business Platinum and corresponding to a Personal Platinum in providing the Station Credits in Clear Plus and your worldwide entry or TSA aetrorcy application (you can use to pay your usual friend app). These credits deserve the same as the amex platinums, and are released at the same time.

Registration is required for the acquisition of the selected benefits; Conditions apply.

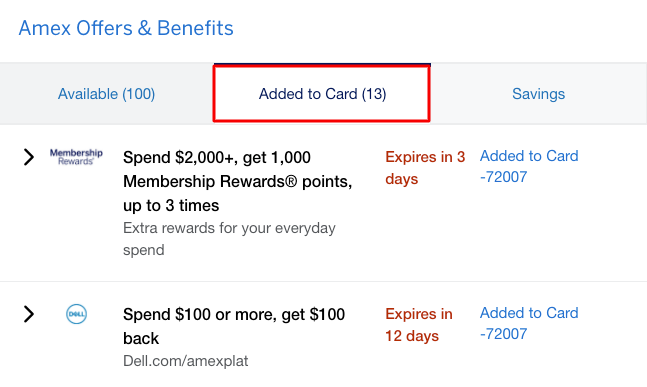

Amex offers

All American Express cards, including platinum cards and platinum businesses and Business Platinum, come up to AMEX offers. You can find outstanding offers when you submit the “amex Offer & Benefits” on your On account account page or click the “OFFER” tab on the Amex app. They are targeted in each Cardmember and from the sellers including hotels, travel suppliers, restaurants and clothing and jewelery. This offer is usually:

- Spend $ X, Get a number of bonus points.

- Spend $ X, get $ Y back.

- Get extra points with each dollar you use to the selected seller.

While the AMEX is given to be good, you may do much better when you put online shopping sites to get more back or bonus points on your purchase.

NOTE: Depending on the offer terms, using Online Portals, promo codes or other savings options can cause your Amex to provide good print.

That means, the good news is that you can put higher amex stores and other famous Amex industries, including some of the platinum’s platinum business statements. The rightness of this offer is restricted. Registration is required in part of the Amex Affers of your account before redeeming.

Related: Your last AMEX offer guideline

Benefits of travel

Cardmembers have different insurance policies when booking and going shopping with their card, including:

- Currency cancellation and insurance insurance *

- Fooling Trip *

- Mobile Protection *

- Property insurance **

- Shipment Protection **

- Return ** protection **

- Extended warranty **

* Fitness and value level varies with card. Terms, conditions and restrictions apply. Visit Amerseexpress.com/webenefitsguide for details. Policies are written down by New Hampshire Insurance Company, AIG Company.

** The appropriateness and standards of profits vary by card. Terms, conditions and restrictions apply. Visit Amerseexpress.com/webenefitsguide for details. Policies are written down by the Amex Assurance Company.

Some cards remove this protection for the last few years, so these benefits give another reason for booking your trip through the Amex Platinum.

Platinum cards do not only protect only a few of the movements of travel but also to improve your travel experience.

Platinum cards receive access to international rest, giving free cards to any Amex Centurion Lounge and access to additional airport number. Access is limited to qualified drug staff. Overall, cash collection is up to more than 1,400 VIP Lounge in 140 areas – the most important profits.

Indeed, platinum cards also provide some additional benefits to make it easier: Platinum Travel Cavment Cavification can help you move, where landing access to real estate can be located in areas of high-quality restaurants. Favorite access is a way to snatch special seats in cultural events and sports.

Registration is required for the acquisition of the selected benefits; Conditions apply.

Hotel benefits

One place where the two cards passes through to access hotel goals. With both platinum and business business, you will find the recommended golden state in Hilton and Marriott and reach the beautiful amex + hotels. Registration is required for the acquisition of the selected benefits; Conditions apply.

The golden state of the Hilton helps the Perks such as commendable breakfast, the development of the room when it is found and 80% points are available on paid continuity. MARRIT BONVOY status comes with benefits as late significance, the development of 25% of a 25% point bonus.

Beautiful Amex Hotels + Resorts The app that provides benefits such as material in worlds worldwide. These structures include extreme extremes, the daily breakfast of two development, updated with room where the unique area is available (called $ 100 or more).

Some buildings in this program will provide three, four or five nights free, an important benefit if you do not want to use your hotels points to stay.

While you need a single platinum card to enjoy these benefits, just as you make sure you benefit from the benefits while increasing the lead, even if your trip is made for business or happiness.

Increase personal and business use

Perhaps one of the greatest benefits of acquiring both types of Amex Platinum that you can earn a successful 7.7% back in Platinum Card until the lead rate is also true of the previously paid hotels booking amex.

This is because, when you have Business Platinum Card, you have the power to pay the airplane booking points with AMX Travel, and doing so will be 35% of the calendar year). This gets you with the number of 1.54 cents per point.

If you find 5 dollar points in the best travel purchase and redeem those points at the number of 1.54 cents, you receive 7.7% return.

That means, if you increase the American Express of Transfer Partner list, you can find more value. After all, TPG stands out Amex membership Rewards points in 2 CEECS such as our March 2025 estimates.

Another option is that the Amex Business Platinum scotinum that gets 1.5 points for each dollar in the construction of the building and the purchase of the Hub, cloud, and software suppliers. To put it up, the platinum business receives 1.5 points for each dollar in the purchase of $ 5,000 or more. Purchase receiving 1.5 Points with each dollar is limited to $ 2 million of the year all year of calendar (one point with a dollar).

It says, for example, you make $ 11,500 purchases, and you would not be worth a bonus and another card. Overall, achieve 17,250 membership points on the Business Platinum Card – worth $ 345 based on TPG prices.

If you were to use the right amex card without a section bonus of what you buy, you will receive 11 500 membership points – cost about $ 230.

Effectively, you will be getting more than $ 100 in value through the Business Platinum.

Related: How to increase your findings find an Amen Business Platinum

HTTPS: //www.youtube.com/watch?v=aazsmkzgm

A bit of bitterness

Using an Amex Platinum card and Business Platinum Card can find the highest price for both your rewards of receiving and postponed, more than the cardinal card.

COBO is suitable for high-income business travelers and want to take advantage of great monetary, generous credits and elegant travel opportunities.

Although the cost of the year is high, the cardards should be treated with finding a large amount of this pair. Each is a good card for yourself, but having your own wallet can get you the rewards you rebles and help you to extend those points when it comes time to use them.

To learn more, read our full ameges for the Amex Platinum and Amex Business Platinum.

Apply here: Amex Platinum

Apply here: Amex Business Platinum

Prices and Card Payers of the Amex Platinum, click here.

Amex Business Platinum card fees, click here.

Source link