What doesn’t earn American Airlines Loyalty Points

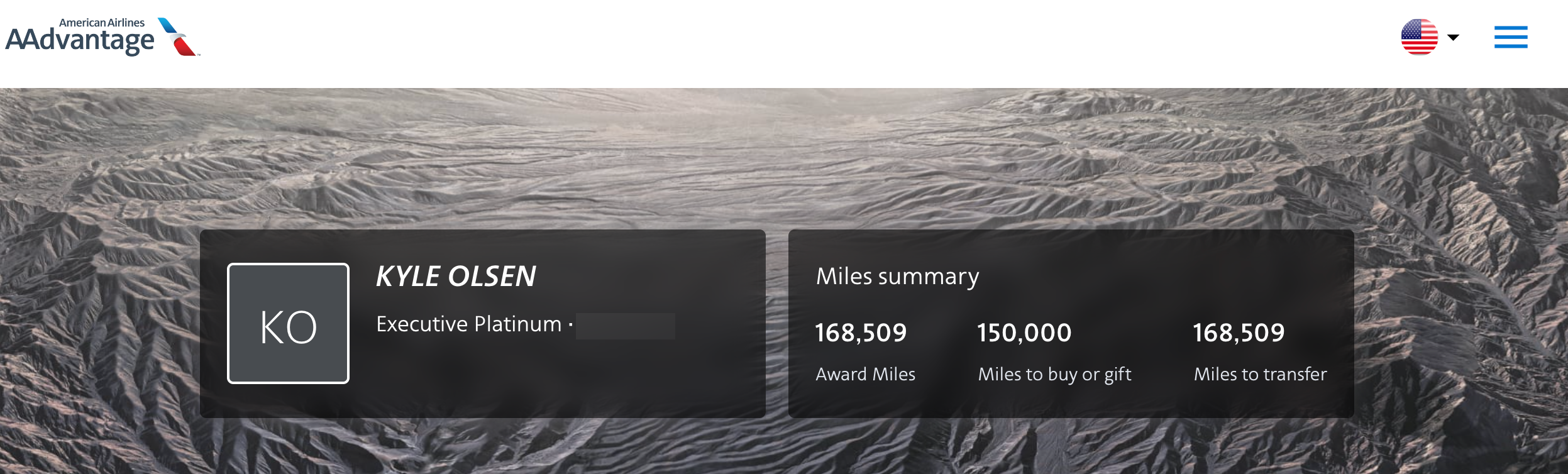

With less than 2 months left until Feb. 28, 2025, when all American Airlines Loyalty Points balances are reset, the race to earn AAdvantage elite status in creative ways is alive and well.

Integrity Score is the only metric used to qualify for American status. From using a credit card to buying flowers through the Advantage Shopping Portal, there are many creative ways to earn Loyalty Points. People may say: “Mile earned, Loyalty Point earned.” But there are many exceptions to that rule.

Just as important as knowing what earns you Loyalty Points is practicing what it is I won’t earn Loyalty Points. After all, we don’t want you to miscalculate your reward balance and not meet the status.

Here are nine Advantage activities that will not accrue Loyalty Points.

Buying, donating or transferring miles

You will not earn Loyalty Points when purchasing, gifting or transferring miles. For example, you can buy 150,000 AAdvantage miles at a 35% discount for $3,668.44. But you will earn 0 Loyalty Points for that transaction.

Similarly, if you transfer or gift Advantage miles to someone else, neither you nor they will earn Loyalty Points.

Related: Current promotions for buying points and miles

Uses Advantage miles

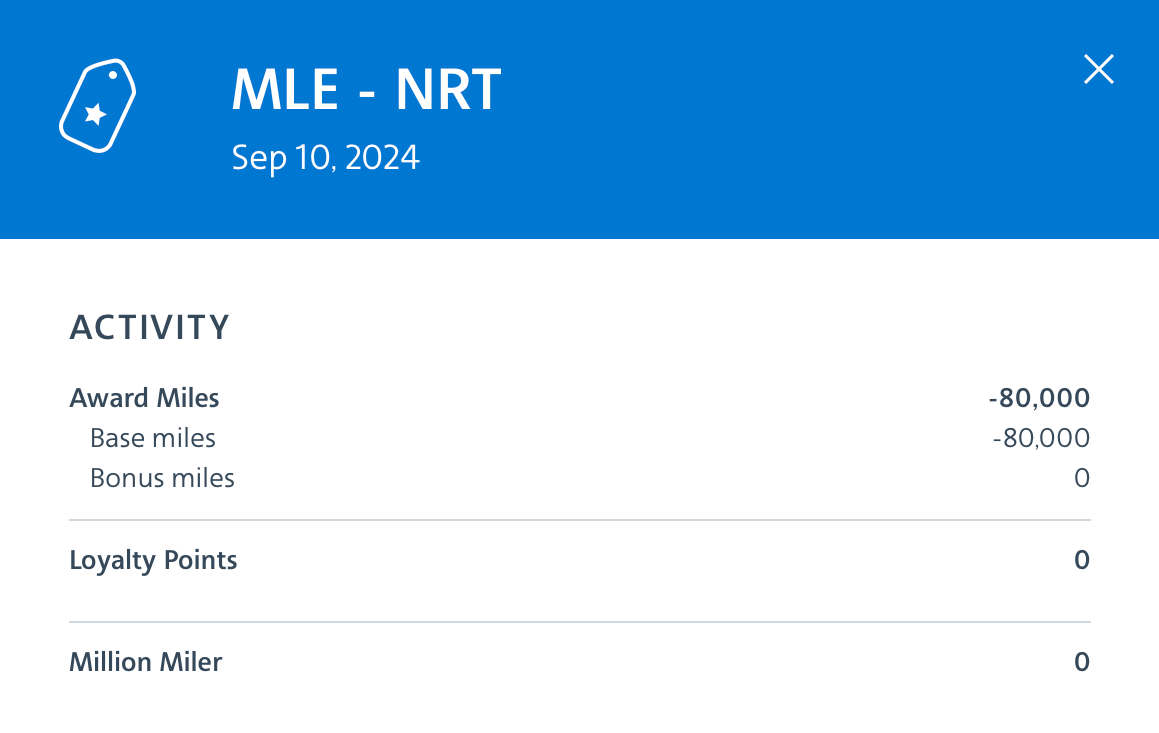

You also won’t earn Loyalty Points when you use AAdvantage miles.

For example, I booked the flight above from Velana International Airport (MLE) in the Maldives to Tokyo Narita International Airport (NRT) via Kuala Lumpur International Airport (KUL) on Malaysian Airlines and Japan Airlines business class for 40,000 AAdvantage miles per passenger. As you can see, I didn’t get Loyalty Points.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for the best news, in-depth guides and exclusive deals from TPG experts

Related: How to redeem miles with the American Airlines AAdvantage program

Welcome offers, use bonuses and special promotions

“Sign up and get 50,000 bonus miles.” “Book now and enjoy 5,000 bonus miles.”

We’ve all heard this offer on airplanes, at airports and when driving American. Unfortunately, you won’t earn Loyalty Points for welcome offers, spending bonuses and special promotions, even if it’s a sign-up bonus on a cobranded AAdvantage credit card. This exclusion also applies to AAdvantage Shopping Portal, AAdvantage Dining, AAdvantage Cars, AAdvantage Cruises, AAdvantage Hotels and AAdvantage Vacations bonuses.

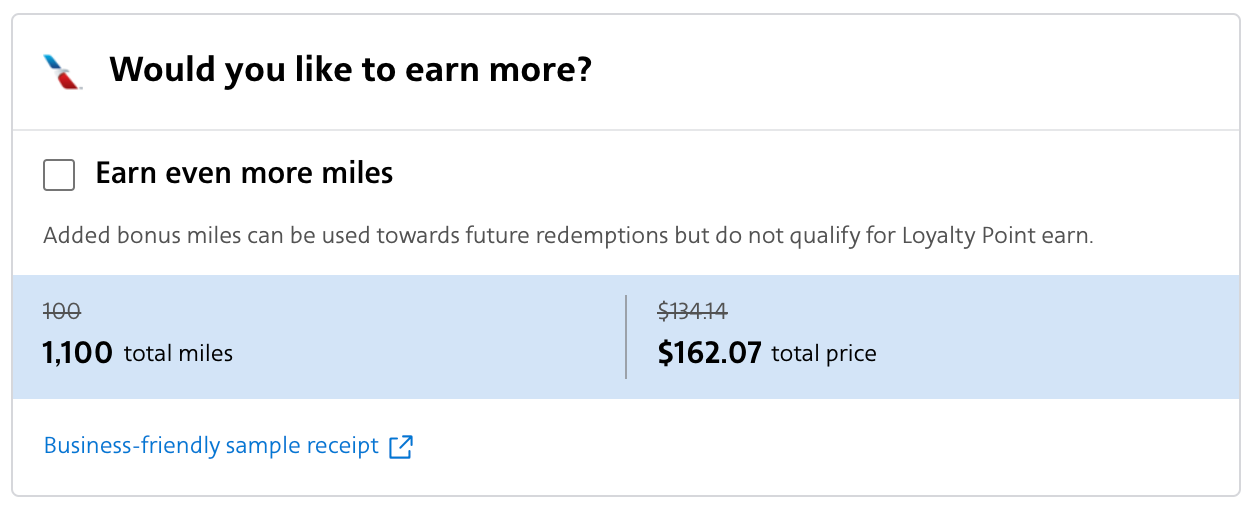

Similarly, AAdvantage Hotels does not award Loyalty Points for additional miles you can add at checkout.

Of course, you will continue to earn Loyalty Points for regular purchases through these platforms, not just bonuses or promotions.

For example, at the time of writing, Viator purchases earn 6 miles for every dollar you click through the Advantage Shopping Portal. In this case, you will earn 6 Loyalty Points for every dollar you spend on Viator travel. However, if a promotion through AA Shopping allows you to earn 2,000 bonus miles for spending $500, you will not accrue another 2,000 Loyalty Points even if you earn 2,000 bonus miles.

Related: Beginner’s guide to airline shopping sites: How to earn bonus points and miles

Credit card bonus categories

You’ll earn a flat 1 Loyalty point per dollar spent on purchases made with your cobranded AAdvantage card, even if the card earns more than 1 mile per dollar in certain categories. Take the Citi® / AAdvantage Business™ World Elite Mastercard® (see rates and fees), for example. Even though this card earns 2 miles per dollar on qualifying American Airlines purchases, gas stations and other bonus categories, you’ll only earn 1 Loyalty Point per dollar spent regardless of where you spend.

However, if you’re a business owner who spends a lot of money on credit cards, charging $200,000 to the card can earn you 200,000 Loyalty Points, enough for top-class Executive Platinum status without ever setting foot on an American plane.

In addition, there are two ways to earn bonus Loyalty Points with credit cards. Travelers with an ADvantage® Aviator® World Elite Silver Mastercard® earn 5,000 Loyalty Points when they spend $20,000 in a qualifying year. Plus, they can earn an additional 5,000 Loyalty Points when they reach $40,000 and $50,000 spent on the card, with a maximum of 15,000 Loyalty Points per year in each case.

AAdvantage Aviator Silver card information has been independently collected by The Points Guy. The card information on this page has not been updated or provided by the card issuer.

On the other hand, the Citi® / AAdvantage® Executive World Elite Mastercard® (see rates and fees) awards 10,000 Loyalty Points after accumulating 50,000 Loyalty Points in a status eligibility year and another 10,000 after reaching 90,000 Loyalty Points in the same eligibility year.

Related: The best credit cards for American Airlines flyers

Bask Bank savings accounts

You’re probably familiar with CD (certificate of deposit) bank accounts: Deposit a certain amount of money over a set period of time without withdrawing it, and you’ll get interest.

AAdvantage has implemented this model in an arrangement with Bask Bank: AAdvantage members can deposit money into the Bask Bank Mileage Savings Account for 12 months and earn AAdvantage miles instead of cash interest. For every $1 you deposit for 12 months, you earn 2 AAdvantage miles. You can deposit up to $200,000 and earn 500,000 miles; mileage interest is paid every month.

In addition, Bask Bank occasionally offers promotions for additional miles. For example, new Bask Bank Mileage Savings Account customers can now earn 10,000 bonus miles after opening a new account in Feb. 28, 2025, fund the account within 15 days and maintain a minimum daily account balance of $50,000 for 180 consecutive days. the first 210 days following initial account opening.

Unfortunately, none of these Advantage miles count as Loyalty Points — unless a limited-time promotion specifically awards Loyalty Points (as we saw in 2022).

Related: 10 ways to earn airline miles without credit cards

Donations to fight cancer

American Rewards awards 10 miles for every dollar you donate over $25 to Stand Up For Cancer. We’ve also seen promotions that offer up to 50 miles per dollar for a limited time. That’s a great return to support a great cause.

Although you earn miles for these offers, you will not earn Loyalty Points.

Related: Giving Tuesday: The 7 best credit cards to increase your charitable giving

Transferring rewards from another currency to Advantage

Since AAdvantage and Bilt Rewards ended their partnership in June 2024, you can no longer transfer credit card rewards to Advantage miles. Marriott Bonvoy points are now the only currency that can be transferred to Advantage, but you will not earn Loyalty Points on these transfers.

Related: When does it make sense to transfer Marriott points to airlines?

The cost of your ticket excluding the base fare and fees imposed by the carrier

When you fly American, you earn miles and Loyalty Points depending on your status:

| The situation | Benefits in basic economic costs | Benefits on all other payments |

|---|---|---|

| Ordinary member | 2 miles and LPs per dollar | 5 miles and LPs per dollar |

| Gold | 2.8 miles and LPs per dollar | 7 miles and LPs per dollar |

| Platinum | 3.2 miles and LPs per dollar | 8 miles and LPs per dollar |

| Platinum Pro | 3.6 miles and LPs per dollar | 9 miles and LPs per dollar |

| Executive Platinum | 4.4 miles and LPs per dollar | 11 miles and LPs per dollar |

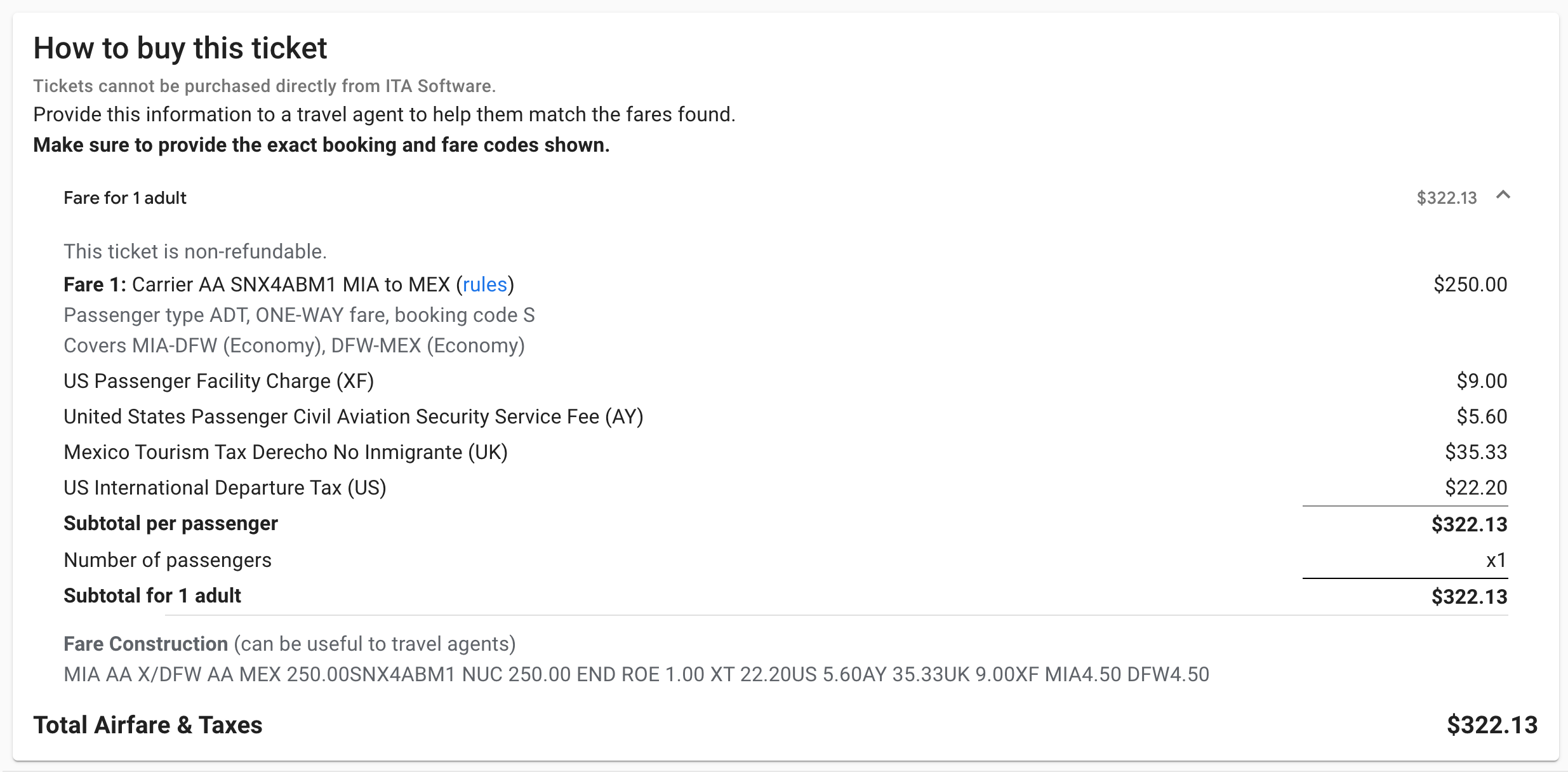

However, you only earn miles and Loyalty Points on the base fare and charges imposed by the carrier. Government-imposed taxes and fees, such as the US mandatory security fee of $5.60 on all tickets, are not eligible for mileage and Loyalty Point credits. Extras like seat selection and baggage fees don’t earn miles or Loyalty Points, either.

You can call American and confirm how many miles and Loyalty Points your booking will earn. Alternatively, you can upload your itinerary in the ITA Matrix and refer to the fare breakdown. Subtract all the taxes and fees imposed by the government, and you’ll see how much money you earn in Advantage miles and loyalty points.

For example, this economy flight from Miami International Airport (MIA) to Mexico City International Airport (MEX) costs $322.13. However, only $250 of this is eligible to earn AAdvantage miles and Loyalty Points. As you can see from the fare breakdown, all other costs include taxes and fees imposed by the US and Mexico.

This means that a non-elite Advantage member will receive 1,250 AAdvantage miles and Loyalty Points, while an Executive Platinum member at the highest level will receive 2,750 miles and Loyalty Points.

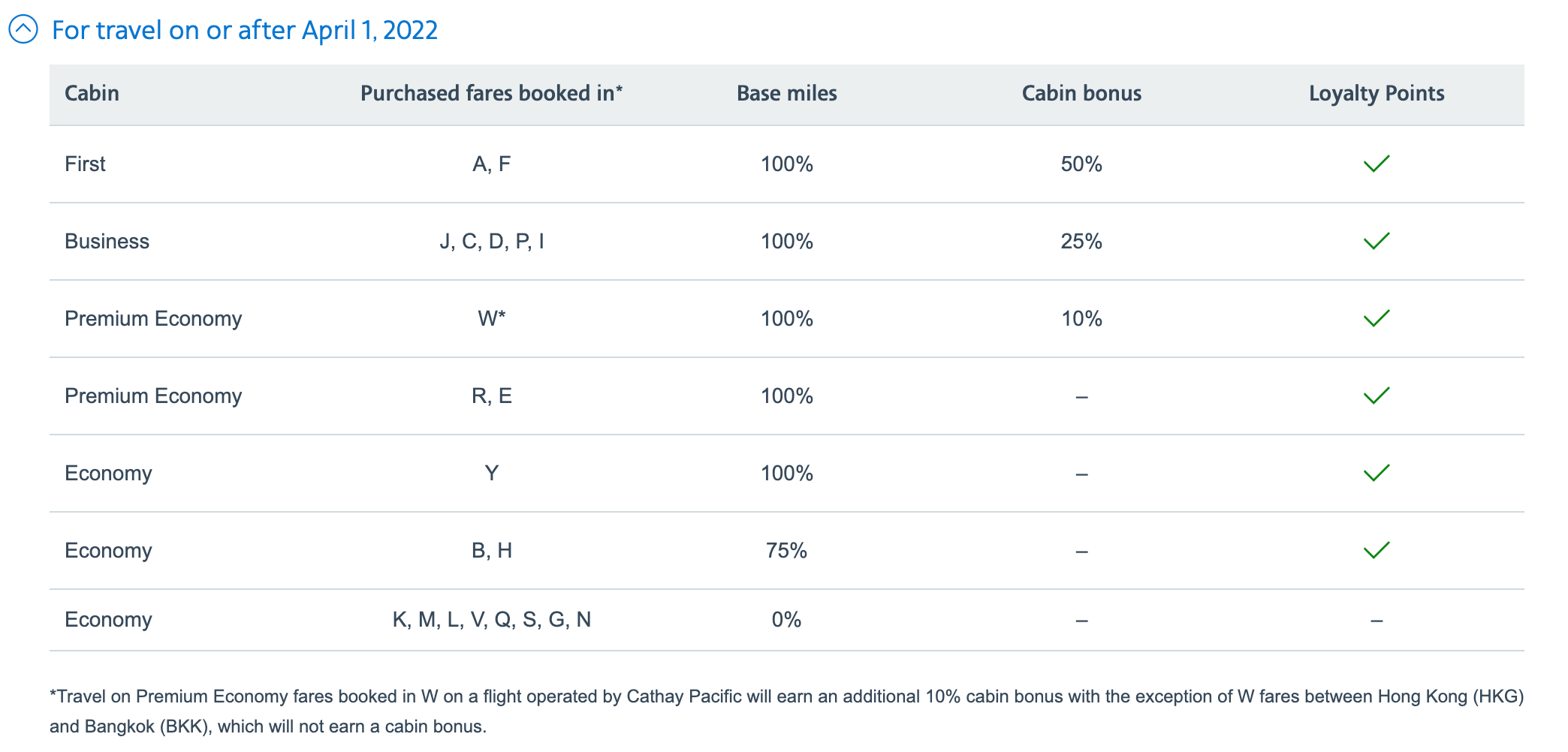

Certain classes of partner funds

Certain partner payments are not eligible to earn miles and loyalty points. As you can see from the Cathay Pacific chart above, premium fares are not eligible for the credit. This means you will not earn miles or Loyalty Points for these types of fares.

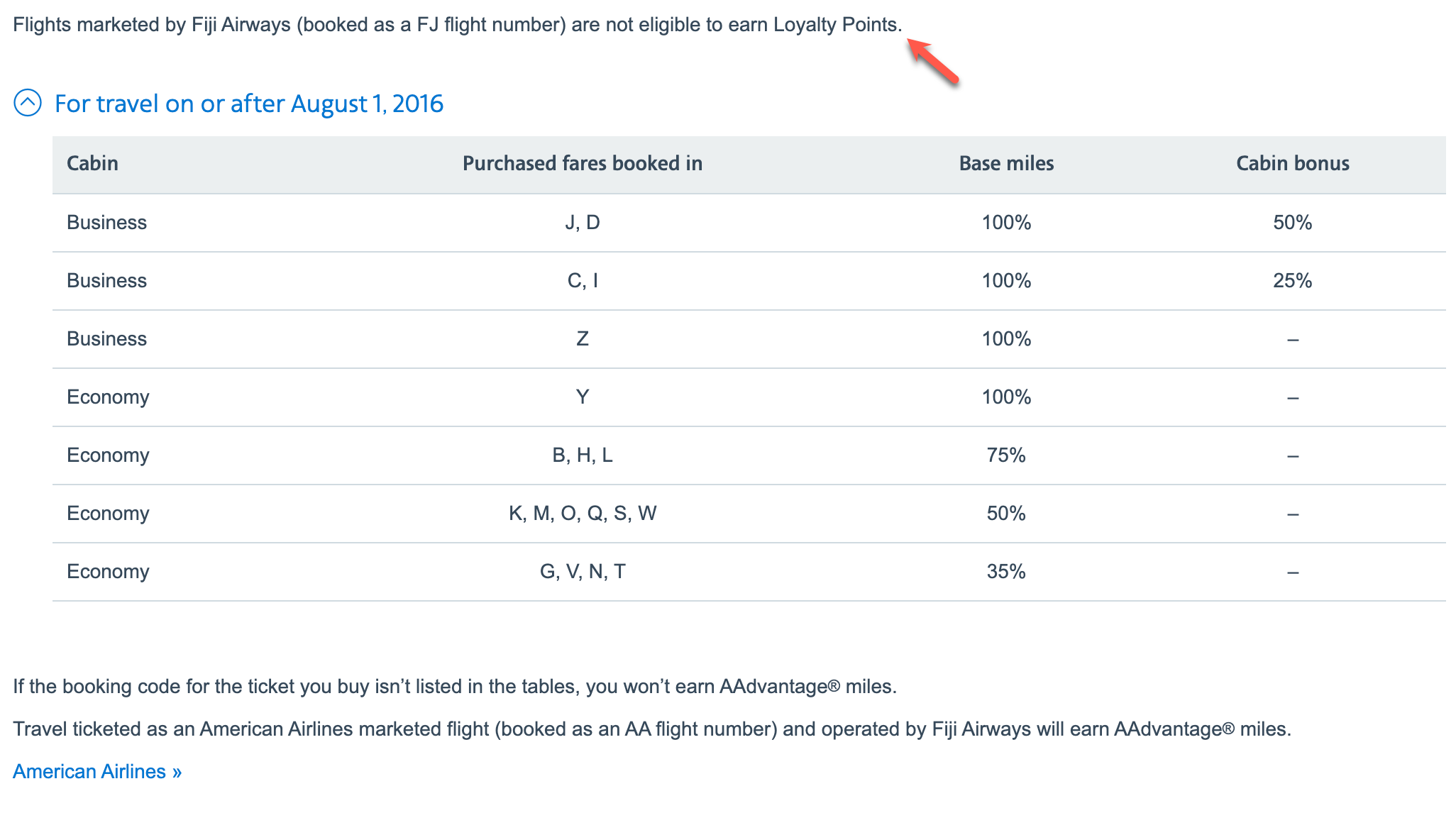

In the case of Fiji Airways, all payments marketed by Fiji Airways (represented by a Fiji Airways flight number) do not earn Loyalty Points.

You can check out the full list of income for our American partners here. If your class of travel is not eligible for AAdvantage mile credit, you will want to redeem the airfare on another Oneworld frequent flyer program.

Related: Fast Points: Earn American AAdvantage status quickly on partner flights

Bottom line

Not all Advantage activities earn Loyalty Points. If you’re after a top position this year, it’s important to know which ones don’t. If you’re chasing AAdvantage elite status, check out our guides on how to earn Loyalty Points and last-minute strategies to earn American’s elite status.

Source link