The credit agency your bank uses news – here

One of the most important things to know when you apply for a credit card where the credit bureau is used to drain your credit report.

Your credit report records your credit history details that you may decide whether to be allowed for a new credit card, such as credit card.

In the US, there are three big debt bureaus – known as credit agencies – that banks and credit card companies can pay to access your credit report: Equifax, Nation, Nation and Trununion.

Related: How to check your free credit score

The credit agreement is used by the card issuer to see that your credit report may determine whether your application is approved or denied, especially when applying for various cards in a short period of time. If several cards drag from the same credit reporting organization, it may affect your chances approved.

However, if the issuers take different credit bureauus to buy your reports, the output cannot see that you apply for a new account elsewhere. As a result, your chances of your cards are to grow.

Many credit applications may reduce your score, so it is important to know what you get before you decide to apply for several days at the same time.

Before you can apply for a new credit line

Knowing your credit is before applying for any kind of new credit is important. Make sure you are checking your credit score and reports before completing the new plan.

Check your credit report

Your credit report records your credit function, including your payment record, prominent liabilities and credit questions. Understanding your credit life gives you a better idea of how your application can view credit card issues. Fortunately, viewing your three credit reports are easy.

Daily newspaper

Update your Inbox and TPG Daily Newsletter

Join more than 700,000 students on matters, deeper guidelines and specialized deals from TPG experts

You can request a free report from the Equifax, Trantinunion and the test once every 12 months online at the OrderCretreport.com.

Related: How you can fix your credit mistakes

Check your credit

While your credit report paints a detailed picture of your credit history, does not include your creditors reasons, so you will want to look.

Checking your credit score, however, it can be more complex. Instead of only three schools – one of each credit reports – there are hundreds of schools available, and some lenders use their custom models. This means that there are thousands of possible credit differences.

The two models are most widely used by the US credit models by the FICO and Vanagescore. Vantagescore, created by the Mait Major Credit Bureaus, have been popular with popular preferences since 2006.

However, FICO is always a industrial standards, with 90% of the holder holder. Most banks offer free FICO schools for those working hours as a useful Perk.

What is FICO Score?

Your Fico Score is between 300 and 850 number based on information your credit report.

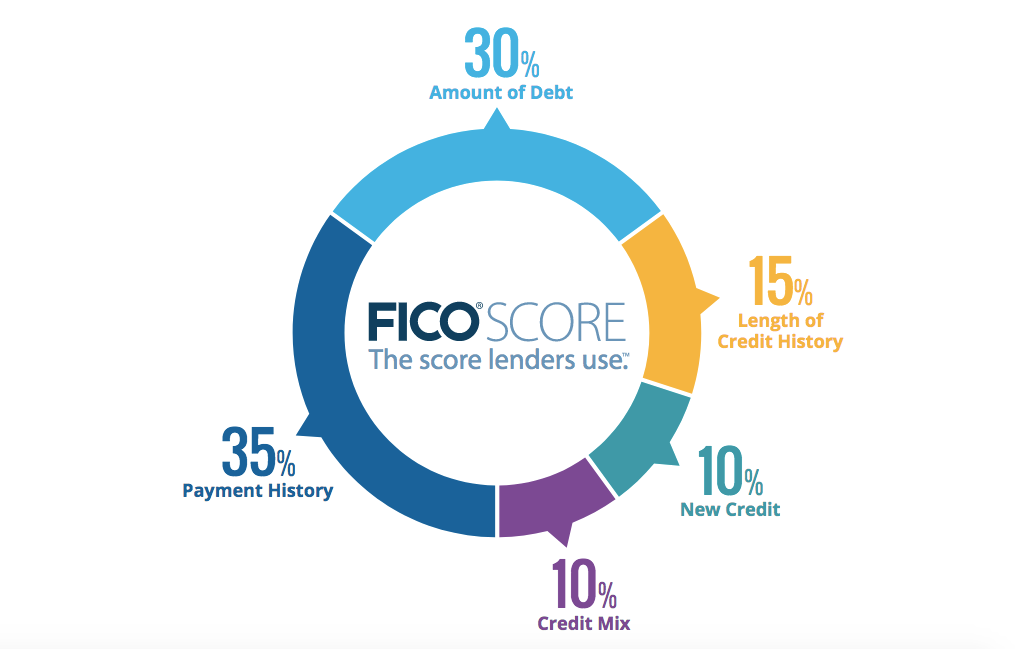

Fico scores are calculated using many different pieces of credit data in your credit report. This data is set up to five categories: Payment history (35%), debt debt (30%), the length of credit history (10%).

Lenders use this method to check your debt – your high school, preferable opportunities for credit cards and other debts.

According to Fico, the “Good” debt falls between 670 and 739, while 740-799 points were considered 500+ “different”. However, to chase 850 full points not required. In many cases, debt card issues have divided the most within the above 720 scores, so a solid score in this child is often enough to prevent good offerings.

Which credit bureaas examine banks – and why does it matter?

When applying for a credit card, your contacts with the credit bureau (or several) to buy a copy of your credit report. The report includes your report by five categories mentioned above.

Related: What are good credit score?

You will see a single credit report stage, which is calculated by 10% of your school, is called “new credit.” If you have multiple credit applications open in a short time, it can affect your poor school.

Consider the following situation: Fill in several new credit plans (Think of money or credit cards) in the last 12 months. These programs appear on your credit reports as a “difficult questions” and can harm your credit score.

He decides to apply to another new credit card. In addition to your score you may have taken Hit, you may see another road block.

Processing your Bank regardless of the interest of which you apply for a new short credit in a short period of time. As a result, there is a chance that can dump the credit card or your debt is in good condition.

Knowing which credit agencies provide credit for the Agency Card used to draw reports can help to avoid the problem. With this handwriting, you can make your own calls (or hold yourself, as possible) in a way that you have developed opportunities to approve your credit cards you want.

Related: 5 test items before applying for your next credit card

Many credit card companies often depend on one bureau when processing credit card programs. The Credit Bureau are using to purchase reports, however, may vary according to the form you live and a particular credit card.

Here is a credit bureaas commonly used by three famous ones:

- Citizing uses all three credit bureaus, but usually drags credit reports from Equifax or Musian.

- The American Express is using all three credit bureaus but primarily drains reports from Experian, although sometimes equifax or Transonion.

- Chase uses all three of the credit bureaus but it loves lessons, but can buy Equifax reports or Transonion.

However, remember that you will never know any credit bureau credit card company will use.

A bit of bitterness

Your credit report is an integral part of your financial profile that causes a significant impact on your debt recovery. By understanding what banks are reported using your debt, you can expand the configuration issues in your submission plan.

Related: 4 Standard Credit Credit

Source link