Inflation cuts $2.5T from retirement plans despite growth in retirement accounts, expert says

Heritage Foundation economist EJ Antoni discusses how inflation could be higher as government debt rises sharply on ‘The Bottom Line.’

INTERMEDIATE: The economic policies of the Biden-Harris administration have had a negative impact on seniors’ retirement plans, according to a new report led by economist EJ Antoni.

The report, shared first with FOX Business, found that the average 401(k) plan grew by $11,000 from 2021 to 2024, but when adjusted for inflation, it represents a loss of $12,000 (9.2%).

The researchers found that retirement plan estimates also increased by nearly $30 billion in the third quarter of 2024. But after adjusting for inflation, retirement plans cost about $27 trillion, a real loss of $2.5 trillion.

HIGH INFLATION IS CHANGING THE WAY AMERICANS EAT

Retirement accounts with large allocations to bonds suffered the most, with bonds seeing their worst returns since 1928, Antoni said. As a result, many retirees will be forced to work another six years to offset the losses caused by inflation.

“Probably the biggest takeaway is that people are caught looking at the stock market and thinking that’s an accurate representation of all kinds of investments, including people’s retirement, and unfortunately, it’s not,” Antoni told Fox Business. the interview.

Antoni said that since many people have a large portion of their retirement savings in fixed income, which has performed poorly over the past four years, many of the gains in the stock market have been offset by losses in these assets. With the added impact of inflation, people who believed they were making smart investment decisions now find themselves lost.

INFL IS UP 20% AS BIDEN TAKES POWER

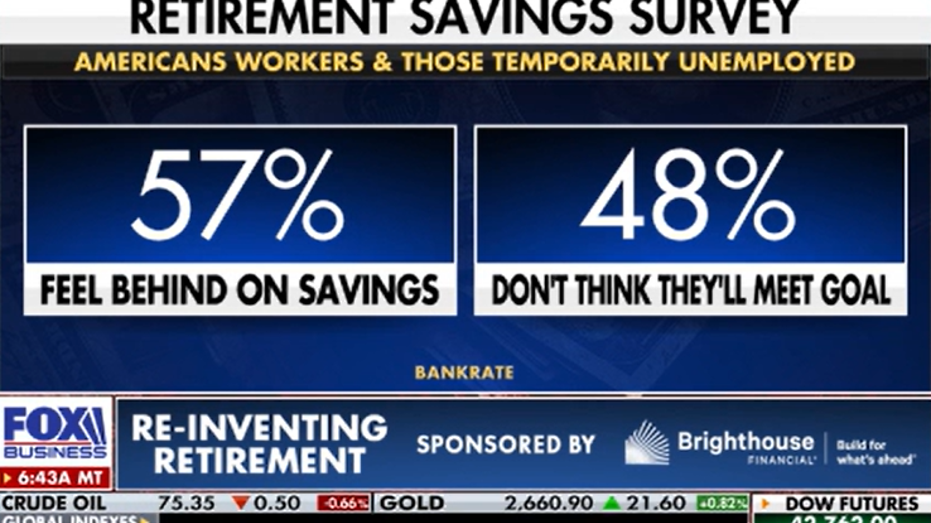

According to a new study from Bankrate, 57% of American workers feel they’re behind on their savings, and 48% of those surveyed don’t think they’ll meet their retirement goals. (Fox Stories)

“The biggest policy mistake of the Biden-Harris administration in terms of impacting the cost of living for seniors has been the crazy amount of government spending,” Antoni said. “That’s what gave us 40 years of inflation. That’s what gave us this violent change in interest rates, and that’s what gave us this massive meltdown in the bond market. So, all of these things combined really delivered a kind of one-two knockout punch. “

America’s national debt has risen sharply, research has shown, and Treasury estimates predict it will exceed $36.2 billion by the end of the calendar year.

Additionally, the Biden-Harris administration has significantly reduced the money held by the Treasury, known as the Treasury General Account, by nearly $1 trillion since taking office, Antoni said.

“Therefore, not only is there overspending in terms of the debt that has increased, you are overspending with a decrease in savings,” he said. “So, [when] if you put all this together, the government has spent more than 9 billion rands in four years. That’s a quarter of all government debt. So, I think that kind of puts into perspective when we talk about the spending problem how bad it’s been under the Biden-Harris administration. “

VP KAMALA HARRIS ANSWERS WHY MOST AMERICANS TRUST TRUMP ON THE ECONOMY

(Annette Riedl/photo alliance via Getty Images)

The researchers conclude that high levels of government spending have caused inflationary shocks that have reduced the real amount of people’s savings. As the government continues to run billions of dollars in annual deficits, the rising cost of paying interest on the federal debt could reduce funding for other programs, including Social Security. Even if this doesn’t happen, debt servicing costs are growing much faster than state income or federal tax revenue.

This creates a cycle where increased borrowing leads to higher interest payments, which adds inflationary pressure to the economy.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“Reductions in government spending will reduce that inflationary pressure, benefiting the wealthy and retirees. Adequate cuts in spending could put the deficit and government debt on a sustainable path, relative to economic growth, and reduce problems related to debt servicing costs,” the report said.

In May, a survey published by Nationwide found that a growing number of older Americans are delaying or leaving retirement plans as they continue to fight chronic inflation.

The uncertain economic climate has many Americans rethinking whether retirement is a realistic goal. More than a quarter of all non-retired investors say they may be forced to return to work at some point due to insufficient savings if they retire within the next 12 months, while 19% doubt they will ever save. enough money for retirement.

An additional 19% said they would retire later than planned because of inflation.

FOX Business’ Megan Henney contributed to this report.

Source link