France Will Not Be Budgeted, Finance Minister Says

(Bloomberg) — Finance Minister Antoine Armand said France will not accept a budget deadline from Marine Le Pen as the far-right party leader gave her strong indications that she intends to topple the government as soon as this week.

Read more from Bloomberg

Le Pen’s National Assembly has threatened to back a motion of no confidence unless Prime Minister Michel Barnier adjusts his 2025 budget to target pensions to inflation among other demands. The opposition leader told Barnier he needed to make changes on Monday, when opposition lawmakers are expected to begin the process of calling a vote of no confidence.

“The French government does not make decisions,” Armand said in an interview with Bloomberg Television on Sunday. “We will not be treated badly.”

Bond investors have punished France’s huge debt relative to its peers amid political turmoil in Paris, pushing borrowing costs at one time last week as high as Greece and leading Barnier to warn of a “storm” in financial markets. The political crisis and market turmoil began in June when President Emmanuel Macron called snap elections in an attempt to clear a National Assembly where his party was already short of a majority.

Le Pen, who leads the largest party in the National Assembly, was swept to victory last week after Barnier agreed to stop raising electricity taxes, one of the main demands of the National Rally. This emboldened the group fighting for the right to add to their demands. A no-confidence vote could happen as soon as Wednesday.

The euro fell in early Asian trading on Monday as investors reacted to Armand’s comments. The common currency fell about 0.4% to about $1.054.

“The political turmoil in France is certainly not helping the euro,” said Rodrigo Catril, a strategist at National Australia Bank Ltd. in Sydney. “The actual collapse of the government through a successful vote of no confidence will add another layer of uncertainty.”

Barnier’s budget law, which includes 60 billion euros ($63.5 billion) of reforms, is an attempt to bring order to France’s financial situation, as the country’s deficit is expected to reach 6.1% of economic output this year.

Budget Minister Laurent Saint-Martin told Le Parisien newspaper over the weekend that the budget amendment requests will cost around 10 billion euros and that the government will not make any further concessions.

Le Pen criticized the comments, telling AFP that Barnier’s administration had “finished the negotiations.” He has made it clear that if his red lines are not reached, his party will join the left to overthrow the government. Rally National President Jordan Bardella accused the government of putting its very existence in jeopardy “because of stubbornness and sectarianism.”

The growing opposition has encouraged investors to bet that Le Pen is preparing to sack the government.

The yield premium between 10-year government bonds and German safe-haven bonds, a closely watched measure of risk, recently touched 90 basis points – the largest since 2012 – before firming back to around 80 basis points on Friday. France’s benchmark equity index is on track for its worst year against European shares since 2010.

France’s 10-year bond yield last week matched that of Greece, the country once at the center of Europe’s debt crisis. Armand dismissed the comparison, saying the French economy is strong.

“Greece has done a great job after the crisis to reduce public spending,” he said. “But France is not Greece. The French economy is not the Greek economy.”

What Bloomberg Economics Says…

“Getting the budget through parliament and the survival of Prime Minister Michel Barnier’s cabinet will likely depend on the decisions of far-right politician Marine Le Pen.”

-Antonio Barroso, Eleonora Mavroeidi. For full information, click here.

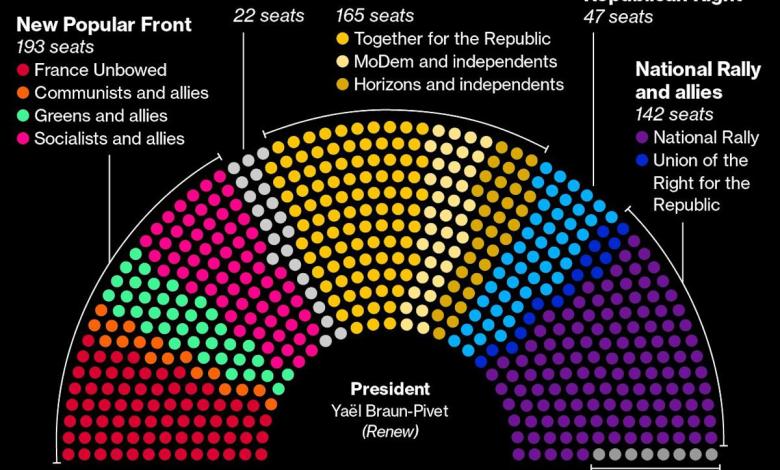

Macron’s gamble on a snap election has left the lower house divided into three bitterly opposed blocs: the waning center that supports the president, the left-wing coalition and the hard-right led by Le Pen. With no coalition possible, Macron appointed Barnier as prime minister in September with the ambitious goal of fixing France’s fiscal situation.

Even before the political upheaval of the past few weeks, France’s finances were a major concern for investors as plans to cut debt fell through at the end of 2024. With tax revenues well below estimates, the government now expects the budget deficit to reach 6.1% of economic output this year instead of falling to 4.4% as originally planned.

Barnier’s 2025 budget aims to reduce the deficit to 5% with shock treatment of 60 billion euros of tax increases and spending cuts. In the interview, Armand stressed that committing to the commitment to reduce the budget deficit to 5% in 2025 and to 3% in 2029 “is not an option.”

“What is my responsibility as the Minister of Finance is that I am committed to the 5% that we decided to have at the beginning of our work, not only for France or the government because it is now necessary for Europe to continue to be a continent of prosperity. ,” he said.

There are no proposals for a government collapse so close to the end-of-year budget deadline. Still, lawmakers and legal experts have pointed to emergency measures that would allow the state to raise taxes and pass spending laws to avoid a shutdown.

The National Rally said it would support this outcome, while the ministers warned that it could involve dangerous money and interfere with efforts to fix the finances. Le Pen also downplayed the consequences of not having a budget at the end of the year, telling La Tribune newspaper that “the French system is well designed, and there is absolutely no reason to panic, because nothing is certain.”

If Barnier is fired, Macron will have to re-elect him or choose a new prime minister. But the president will face an equally difficult balancing act unless new legislative elections are held until July.

Any new government that emerges will still urgently need to raise the 2025 budget.

Armand tried to reassure investors, saying he is confident that France will continue to repair its economy and attract investors.

“France is committed to maintaining this European leadership with Germany, with Italy, with Spain, and with all European countries so that this growth agenda is the best answer to the international and commercial conflicts that are going on now,” he said.

–With assistance from Ania Nussbaum, Benoit Berthelot and Ruth Carson.

(Added financial strategists’ comments in section seven.)

Best Reads in Bloomberg Businessweek

©2024 Bloomberg LP

Source link