Consumer Warning: Senators are trying to write anti-score points and mile laws to be a waiting payment

The bad news of the points of points and miles: some US tries to press the credit card competition as a “pope pilter” in the expectations of a voting law enforcement.

Sen. ROGER MARSHALL, the Republican from Kansas, filled the amendment last week in his name and Sen. Dick Durbin, Democrat from Illinois, adding the Illinois invention to the US Stablecoins Act.

The Genius Act found Bipartisan support, and initially, seemed to have passed a number of 100 votes keys. The Legal Servers say that it will allow the best control of the Cryptocurrency market and provide additional strengths of general digital finance markets.

The Senate leader John Tune allows amendments to the Bill, which opens the opportunities for CCCA attached to the Bill if the Senata votes. However, at least one Senator has said that he will withdraw his previous Support for the actual act when CCCA is finally attached.

“If it had to be accepted by wisdom, I withdrew my support on the Senate,” Sen said. Thom Tillis, Republican from North Carolina, according to Washington Reporter.

And some other Senators cost a “clean” vote without amendments.

Including Senator Cynthia Lummis, Republican from Wyoming and Senitor Bill Harverty, a receptionist from Tennessee.

The Deputy President of the JD Vasas also swept the vote “clean” without the CCCA attached law.

Unfortunately, if Marshall and Durbin succeeded the votes in the signature to allow the amendment, the CCCA will be added to the Bill. This will forcing the Senators to choose between voting in the famous law in questioning the transformation of opposing amendment or allowing the total fees through and dealing with the results of the CCCA.

Daily newspaper

Update your Inbox and TPG Daily Newsletter

Join more than 700,000 students on matters, deeper guidelines and specialized deals from TPG experts

Tell Congress You do not delete your credit card rewards: Protect your points

“This is a political love [the bill’s] Supporters of the Great Campaigns of Campaigns, “said Richard Hunt, the presiding management agreements.

Electronic Payment Coalition is a trading organization that represents unions, public banks and payment card networks.

“The bill has never exceeded the relevant committee, never discussed, and never reinstated the conference,” Hunt said. “Unlike Genius Legislature, Durbin-Marshall Sponsors [the Credit Card Competition Act] He has not made their right diligence. “

TPG is very resistant to CCCA because we believe it will destroy the friendly benefits of credit card consumer.

What is the Credit Card Competition Act?

The CCCA sets prices in exchange for exchanging and can remove Bonus Benefits and Points to earn more banking points, aircraft and credit hotels.

When the same rules are passed on Debit cards in 2010, consumers are promoted by lower prices for goods and services because the small amount of cash exchange will be forwarded to consumers. That didn’t happen. Instead, it identifies the lead and enrolling bonuses in those cards disappearing, and prices go up.

The study of the Law and economic facility estimates that the CAPs in the Draft Financial Exchange has placed a large amount of $ 6.6 million to $ 8 billion. This loss of income has contributed directly to reducing free test accounts and rewards of rewards.

Electronics Payments Coalition Tell TPG that “Durbin-Marshall Bill allows Mega Mega stores such as Walmart, the target and the Home Deputy Credit Card option – without checking for consumer security or benefits.”

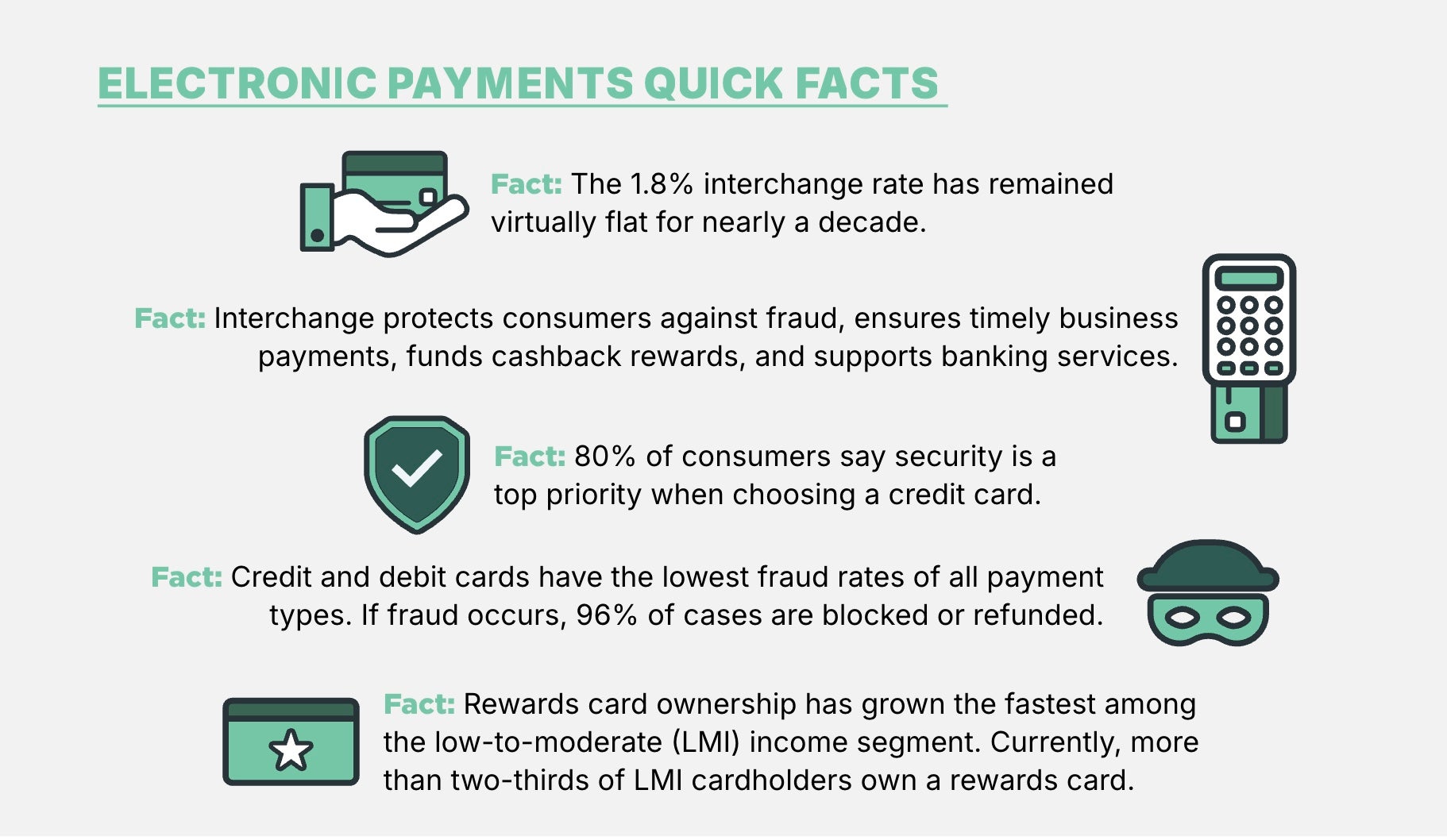

Electronic Payment Coalition also points to:

- The Bill may force transactions to unsafe networks, deception protection that reduces the costs of business and consumers.

- It threatens credit card rewards, including the benefits of Cash Back that help brokers to fight prices and help small businesses.

- Small businesses can face high costs and few benefits to accept card payments.

Studies show that the bill may cause the US recession, costing $ 227 billion in lost economic and almost 156,000 in lost work.

The University of Miami study found that the CCCA would highly reduce the income of public banks and credit unions while reducing access to debt and small markets across the country across the country across the country.

As a company established to use credit card rewards to help save money on travel, TPG is between many interested organizations.

A variety of set from the industry, including trade unions, minority owners, financial owners (such as credit agencies) in all 50 provinces, trade organizations, strongly reflect the law.

How can you help to protect your points

While working with the TPG credit card issues, our employees and millions of our students and saw themselves how reward programs can be opened where it can be found. By making easy access, we help our readers extend their cold, open their mind and find different cultures – all allowed to pass if I am amended.

“This can be a disaster for consumers,” said TPG founder Brian Kelly. ” [They] You will lose rewards, shopping and fraud protection, while sellers can add to their low line. “

In partnership with Electronic Payment Coalition, TPG is introduced to protect your points, platform to persuade TPG students to express opposition to their local lawyers and Seneters.

Click this link to submit a quick form. Please take 30 seconds today to tell your Senator to vote against the amendment of the CCCA in the Professional Law.

Related Reading:

Source link