A Guide to Foreign Exchange Funds: The Unknown

There are few things we dislike more about TPG than unnecessary fees – including foreign exchange fees.

You may have noticed that when you use other credit cards abroad (or on a website that is not accepted in the US), additional fees are added to each purchase.

Let’s find out what those fees are and how to avoid them in the future.

Related: the best cards with no foreign transaction fees

What is foreign currency?

A foreign exchange fee is charged to certain cards when you make a purchase that goes through an international bank to process the transaction.

When completing a transaction while traveling or through a foreign website, banks may need to convert purchases to US dollars. For some credit cards, issuers will pass the conversion fee on to consumers.

Related: the best credit cards with no external transaction fees

How much is the foreign exchange fee?

VISA and MasterCard charge banks a 1% processing fee for purchases made abroad, and many American rivals charge an additional 1-2% fee. The foreign transaction fee is usually around 3%. However, one capital and finding is different by having zero foreign transactions on all their credit cards.

Which cards do not have foreign transaction fees?

Most major credit cards do not charge foreign transaction fees. In fact, it’s rare for a card that offers travel rewards and Perks to charge any foreign transaction fees.

Daily news paper

Refresh your inbox with the TPG Daily Newsletter

Join over 700,000 readers with news, in-depth guides and exclusive deals from TPG experts

While some issuers charge foreign transaction fees of around 3% on some of their products, you should consider single currency or captive cards or don’t charge foreign transaction fees on any of their cards.

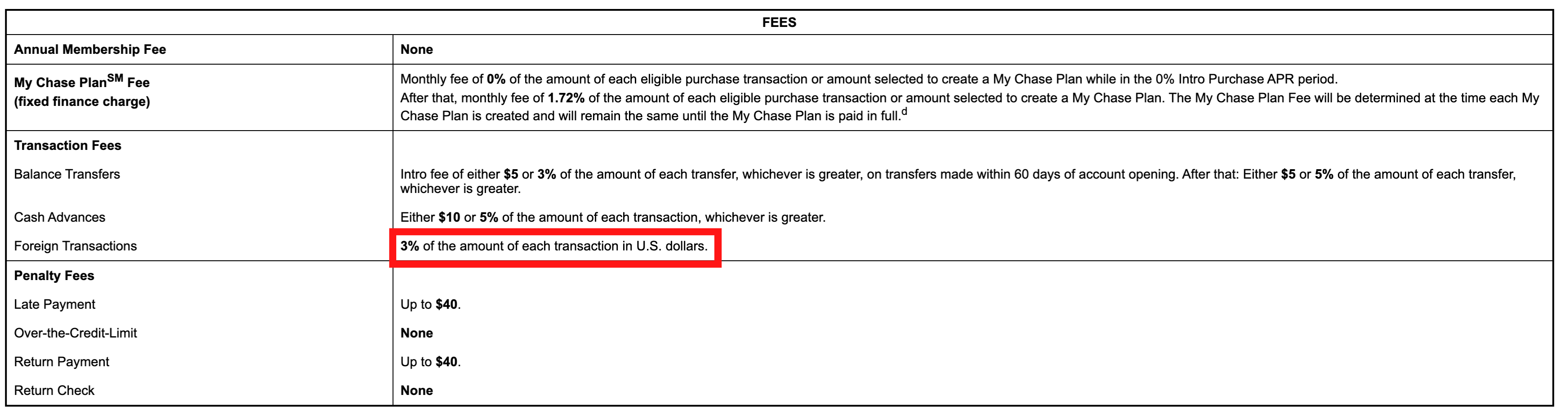

Card issuers are required to provide potential and existing customers with access to the rates and fees associated with the credit card, including foreign transaction fees. Check your credit card’s terms and conditions to see if your card (or the card you’re considering applying for) charges a foreign transaction fee.

When looking at table rates and fees, foreign exchange fees are usually listed clearly under the fees section.

Related: How to Choose a Foreign Currency Credit Card

Foreign currency vs. ATM money

Another type of currency you may hear about when traveling is foreign ATM currency. While both fees may apply when traveling outside the US, they are not the same.

A foreign exchange fee is charged when you withdraw money from an ATM in another country. Some banks reduce this fee, especially if you use an ATM that falls within a certain banking network.

In addition, you may be on the hook for fees when using an ATM abroad, including cash in your apartment for using an ATM that is not connected to the Banky Conversion Rate (which usually falls in line with the foreign transaction fee of 3%) and additional fees charged by the owner of the -The specific ATM you use.

This is one reason we recommend paying by credit card where possible. But in some areas, cash is still king and you’ll need to have a game plan to avoid these types of expenses — or include them in your budget.

Related: Ways to save on overseas withdrawals

How to Avoid Foreign Transaction Fees

Use the card without foreign currency

An easy way to avoid foreign transaction fees is to use a no-fee card. TPG has a regularly updated guide to the top credit cards with no external fees that can help you choose the best cards for your trip.

Unfortunately, the cards behind the money like Chase Freedom Unlimited® and Blue Cash Cash Capped Cash Expressional from American Express (See prices and fees) often charge a foreign transaction fee.

Related: Benefits and Benefits of Cash-Back Credit Cards

Avoid ‘Dynamic’ Financial Changes

When using a card terminal abroad, you may be told to pay in the local currency or in US dollars. You should always choose the local currency.

Dynamic currency conversion is a great way for banks to encourage you to pay in your home currency (US dollars) while abroad. However, they tend to give you a poor conversion rate, so it is better to pay in euros, pesos or any local currency.

Related: Why you should avoid strong currency conversions

Pay in cash

Of course, you will avoid foreign exchange fees by paying in cash.

However, those purchases won’t earn you rewards, and withdrawing money abroad can be subject to pesky fees.

Related: How to Decide How to Use Earnings or Miles to Buy Airline Tickets

Underlying bitterness

The good news is that foreign transaction fees are more common on top credit cards than ever before. We hope that the entire industry moves away from charging customers these types of fees. Until then, check your credit card’s terms and conditions so you know you’ll be on the hook for cash when you travel — and plan your card usage accordingly.

To avoid foreign transaction fees, choose a high travel rewards card or one from capital one or find. Also, always pay in local currency rather than US dollars to avoid poor conversion rates.

Related: Best Travel Rewards Cards

For prices and fees of selected blue coins, click here.

Source link